Sustainable Growth: Our systematic exploration approach has consistently replaced and grown reserves at operating mines, ensuring long-term production stability

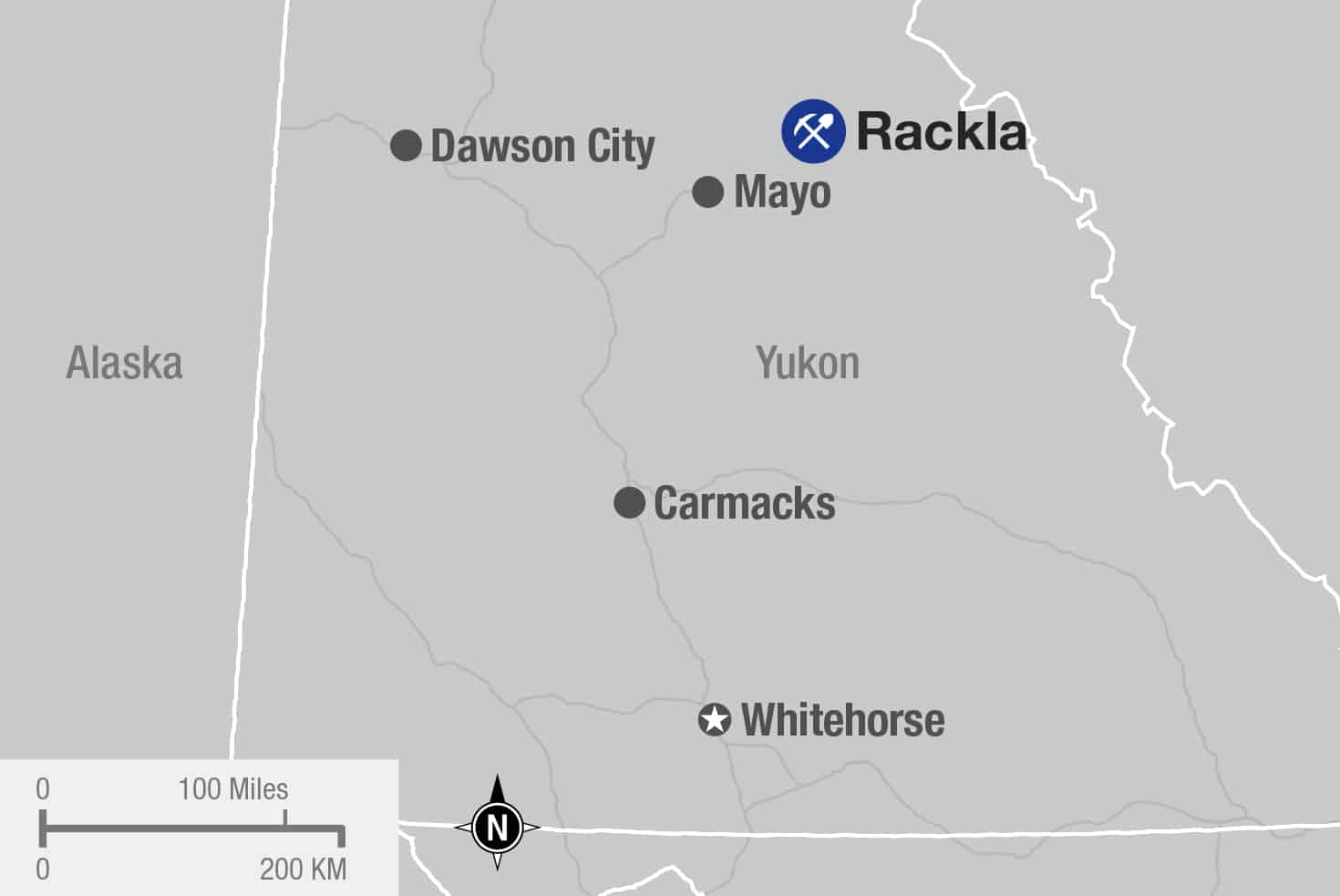

Discovery Track Record: Recent successes include Bermingham and Flame & Moth at Keno Hill, Green Racer Sinter at Midas, and multiple high-grade intercepts across our portfolio

Infrastructure Leverage: Existing mills and permitted facilities at Midas, Aurora, and other sites dramatically reduce capital requirements and accelerate timeline to production

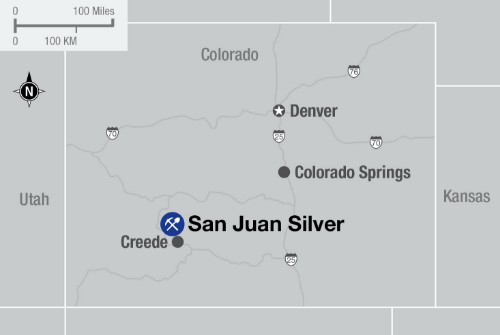

Prime Real Estate: Our land positions encompass some of North America’s most endowed precious metals districts, many consolidated under single ownership for the first time

Technical Excellence: As one of North America’s leading precious metals producer, Hecla combines 134 years of mining expertise with cutting-edge exploration technology and data analytics

Value Creation: Every dollar invested in exploration targets long-term shareholder value through resource growth and discovery potential

Risk Mitigation: Diverse portfolio across multiple jurisdictions and deposit types provides balanced exposure and multiple paths to growth

Hecla’s exploration pipeline represents one of the industry’s most compelling organic growth opportunities. With dominant positions in world-class districts, a proven systematic approach, and strategic capital allocation, we’re positioned to deliver the next generation of high-grade precious metals discoveries.

Our Nevada portfolio alone offers transformative potential through multiple high-grade projects with existing infrastructure, proven mineralization, and vast underexplored targets. Combined with aggressive programs at our producing assets and systematic advancement of our development projects, we have created multiple catalysts for significant resource growth and new discoveries.

Our commitment to exploration isn’t just about finding ore—it’s about securing Hecla’s position as North America’s leading precious metals producer for decades to come, while creating exceptional value for shareholders through responsible, systematic mineral development.